expanded child tax credit build back better

One of the significant temporary expansions to the credit was that it. In a move that could benefit many families House Democrats passed the 175 trillion Build Back Better Act Friday which includes a one-year extension of the enhanced child tax credit CTC.

Voters Are Divided Over One Year Extension Of Expanded Child Tax Credit

The original Build Back Better Act would have included a one-year extension of the expanded child tax credit which was nationally popular but.

. The expanded CTC represents the biggest investment in American families and children in a generation. Build Back Better could also eliminate the CTCs bump-up for young children. According to NBC News Manchin has told reporters that any expanded child tax credit should include a work requirement and he floated an income limit of 75000 or less.

According to CNBC as of Nov. While most Democratic senators are in favor of the expanded child tax credit uncertainty surrounding the Build Back Better Act is putting the potential of an extension in doubt. The Build Back Better bill will likely include a provision to extend the expanded child tax credit most likely for another year.

The Build Back Better Act increases the Child Tax Credit by 1000 to 1600 depending on the childs age. As the White House continues negotiations on the critical Build Back Better BBB package we respectfully ask you to work to extend the American Rescue Plans ARP expanded Child Tax Credit CTC as a centerpiece of the legislation. This would set the CTC at a flat 3000 per child doing away with the extra 600 for children under 6.

16 the Build Back Better program only extends the credit through 2022 with the amount per child dropping to just 1000 per child after 2025. The Build Back Better framework will provide monthly payments to the parents of nearly 90 percent of American children for 2022 300 per month. To make this less painful for current families it could phase out the young child bonus over five years effectively grandfathering in todays families so they dont bear a loss.

Democrats are fighting to get the payments which expire at the end of 2021. That increase begins to tail off sharply for couples making over 150000 and is gone. However a final.

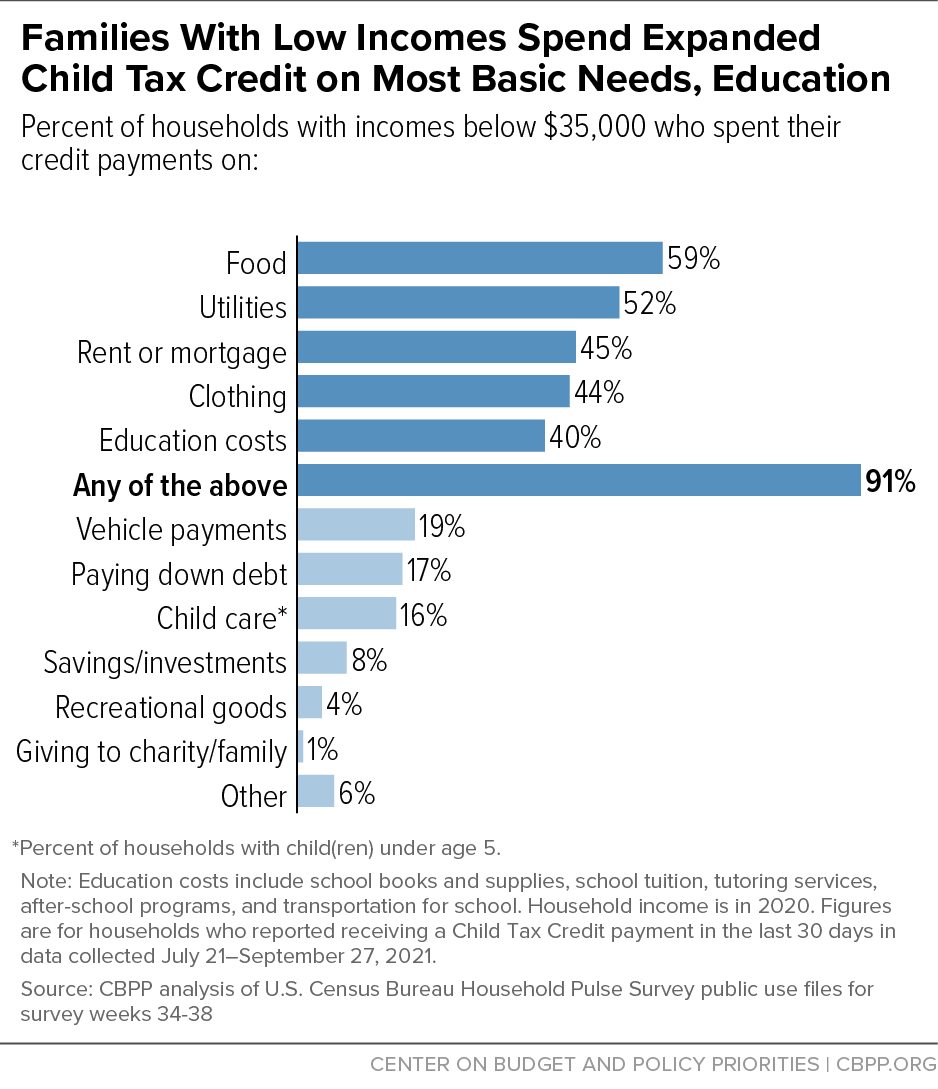

The Build Back Better proposal will extend the credit at least through 2022. Altogether Build Back Betters Child Tax Credit expansions full refundability and expanding the maximum credit to 3600 for children under age 6 and 3000 for children aged 6-17 are expected to reduce child poverty by more than 40 percent as compared to what it would be without the expansion. The second and larger bill sat within Bidens Build Back Better Act and subsequent increases to the federal tax credit but it couldnt get past the Senate in late 2021.

Under Build Back Better families could receive advance Child Tax Credit payments of 300 per child under 6 and 250 per child ages 6-17 via Direct Deposit for the entirety of 2022. The House approval of the Build Back Better Act on Friday paved the way for extending the credit into the 2022 tax return season but Markey other progressive lawmakers and many health officials. Up to 1800 per child will be able to be claimed as a lump sum on taxes in 2022.

The Build Back Better framework will provide monthly payments to the parents of nearly 90 percent of American children for 2022300 per month per child under six and 250 per month per child. House Speaker Nancy Pelosi D-CA promotes the expanded Child Tax Credit on July 15 2021 in Los Angeles California. The American Rescue Plan passed in March expanded the child tax credit for 2021 through which families are eligible for 3000 per child between the ages 6 to 17 and 3600 for children under 6.

The credit was expanded to lower income families as part of the covid-19 rescue package that passed earlier this year and it now sends up. If the Senate fails to pass the Build Back Better Act by the end of the year the expanded Child Tax Credit will expire and millions of families will. The American Rescue Plan enacted in March expanded the existing child tax credit by 3000 from 2000 with a 600 bonus for kids under the age of 6 for the 2021 tax year.

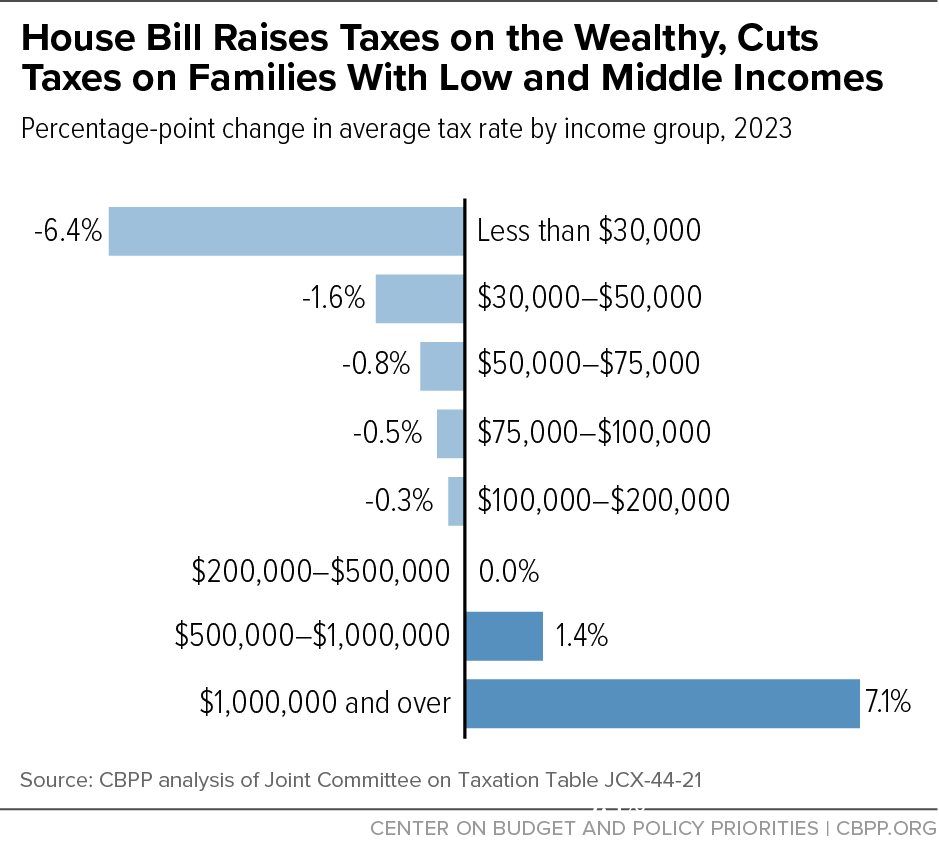

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

The Build Back Better Framework The White House

The Build Back Better Plan Is Stalling What S The Issue

Policymakers Should Craft Compromise Build Back Better Package Center On Budget And Policy Priorities

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

A Recap You Didn T Need Build Back Better Was Popular All Year

Racial Justice Organizations Ask Congress To Reinstate Child Tax Credit

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

Fourth Stimulus Check Update Build Back Better Would Send Monthly Payments Through 2022

Voters Are Divided Over One Year Extension Of Expanded Child Tax Credit

The Build Back Better Framework The White House

The Build Back Better Framework The White House

Joe Manchin Privately Told Colleagues Parents Use Child Tax Credit Money On Drugs Huffpost Latest News

House Democrats Pass Biden S 1 85 Trillion Build Back Better Plan

Tax Credit Reforms In Build Back Better Would Benefit A Diverse Group Of Families Itep

The Build Back Better Framework The White House

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

What S Actually In Biden S Build Back Better Bill And How Would It Affect You Us News The Guardian